How to find cosmetic manufacturer?

Finding the right cosmetic manufacturer involves complex research, qualification processes, and relationship building that can overwhelm new brands. Poor manufacturer selection leads to quality issues, production delays, and costly business failures that destroy brand reputation and market opportunities.

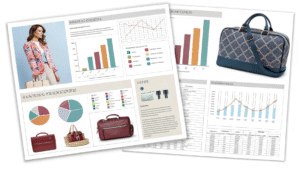

Successful cosmetic manufacturer selection requires evaluating production capabilities, certifications, minimum orders, and communication quality through systematic research and verification processes. Our Q&N experience reveals 2025 trending cosmetic bag colors favor cream, misty blue, and warm beige tones reflecting consumer preference shifts.

Through our Q&N operations in Guangzhou serving global cosmetic brands for 15 years, I understand the challenges brands face selecting reliable manufacturing partners. The shift toward cream, misty blue, and warm beige color palettes in 2025 cosmetic bags demonstrates how consumer preferences evolve requiring manufacturers who adapt quickly to market trends and aesthetic demands.

How to find a cosmetic manufacturer in China?

China's cosmetic manufacturing landscape offers diverse options from small specialized facilities to large-scale production giants requiring careful navigation and qualification processes. Inadequate research and verification lead to quality problems, communication barriers, and supply chain disruptions affecting business success.

Effective Chinese cosmetic manufacturer discovery combines online platforms like Alibaba with trade shows, referrals, and direct factory visits enabling comprehensive evaluation and relationship building. Our Q&N Guangzhou location demonstrates regional specialization advantages while trending 2025 colors like cream, misty blue, and warm beige guide aesthetic positioning strategies.

Alibaba represents the primary starting point for Chinese cosmetic manufacturer discovery through comprehensive supplier listings, verification systems, and communication tools connecting global buyers with qualified producers. Gold Supplier status indicates verified business credentials and platform investment commitment. Trade Assurance provides payment protection and quality guarantees for initial orders. Supplier assessment tools evaluate production capacity, certifications, and customer feedback enabling informed selection decisions.

Made-in-China platform offers alternative sourcing channel with different supplier base and verification systems providing additional manufacturer discovery options. Industry specialization helps identify cosmetic-focused manufacturers with relevant experience and capabilities. Product category filters narrow search results to specific cosmetic manufacturing specializations. Supplier profiles reveal production capacity, certifications, and manufacturing focus areas.

Trade shows provide invaluable face-to-face interaction opportunities enabling direct manufacturer evaluation, relationship building, and product quality assessment impossible through online platforms. Cosmoprof Asia in Hong Kong connects international buyers with Chinese manufacturers through concentrated industry gathering. Canton Fair offers broad manufacturing exposure including cosmetic producers and related industries. Beauty Expo China focuses specifically on beauty and cosmetic industry connections.

Our Q&N experience demonstrates how regional specialization benefits cosmetic accessory production through concentrated supply chains, skilled workforce, and industry expertise. Guangzhou's beauty industry cluster provides access to materials, components, and specialized services supporting cosmetic manufacturing. The popularity of cream, misty blue, and warm beige colors in 2025 requires manufacturers who understand color psychology and aesthetic trends.

Industry referrals provide trusted manufacturer recommendations through established business relationships and proven performance records reducing risk and qualification time. Existing suppliers often recommend complementary manufacturers for different product categories or specialized services. Industry associations provide member directories and referral services connecting qualified manufacturers with potential clients. Professional networks facilitate warm introductions and relationship building opportunities.

Direct factory visits enable comprehensive manufacturer evaluation including production capacity assessment, quality control system verification, and workplace condition observation. Manufacturing facility tours reveal actual production capabilities versus marketing claims providing authentic evaluation data. Quality control system inspection ensures consistent product standards and compliance capabilities. Worker condition assessment reflects manufacturer ethics and sustainability practices affecting brand reputation.

Third-party verification services provide independent manufacturer qualification and ongoing monitoring reducing due diligence requirements and risk exposure. SGS and Bureau Veritas offer factory audits and certification verification ensuring compliance with international standards. Industry consultants provide local expertise and cultural navigation assistance for foreign buyers. Legal services ensure contract compliance and intellectual property protection throughout manufacturing relationships.

Communication assessment evaluates manufacturer responsiveness, English proficiency, and technical understanding ensuring effective collaboration and project management capabilities. Response time measurement indicates customer service priority and operational efficiency levels. Technical competency evaluation ensures manufacturer understanding of cosmetic requirements and quality standards. Cultural compatibility assessment predicts long-term relationship success and collaboration effectiveness.

Minimum order quantity evaluation balances production efficiency with inventory investment determining manufacturer suitability for specific business models and growth stages. Small batch capabilities support new brand launches and product testing requirements. Scalability assessment ensures manufacturer growth capacity matching business expansion plans. Flexibility evaluation determines accommodation of seasonal fluctuations and special order requirements.

| Discovery Method | Advantages | Limitations | Best For | Success Factors |

|---|---|---|---|---|

| Alibaba | Comprehensive listings, verification | Language barriers, quality variance | Initial research, broad options | Supplier verification, communication |

| Trade Shows | Direct interaction, quality assessment | Travel costs, time investment | Relationship building, evaluation | Preparation, follow-up |

| Referrals | Trusted recommendations, proven track | Limited options, relationship dependent | Established businesses | Network development |

| Direct Visits | Comprehensive evaluation, relationship | High cost, time intensive | Serious partnerships | Thorough preparation |

| Third-party Services | Expert guidance, risk reduction | Additional costs, dependency | Complex requirements | Service provider selection |

Which city is famous for cosmetics in China?

China's cosmetic manufacturing concentrates in specific cities offering distinct advantages through industrial clusters, supply chain integration, and specialized expertise. Understanding regional specializations helps brands select optimal manufacturing locations for specific product categories and business requirements.

Guangzhou leads Chinese cosmetic manufacturing through comprehensive industry ecosystem, supply chain integration, and export infrastructure, followed by Shanghai for luxury positioning and Shenzhen for innovation. Our Q&N Guangzhou operations demonstrate regional advantages while 2025 color trends toward cream, misty blue, and warm beige reflect sophisticated consumer preferences.

Guangzhou dominates Chinese cosmetic manufacturing through concentrated industry cluster including raw material suppliers, packaging manufacturers, and finished product producers creating comprehensive ecosystem advantages. Beauty industry specialization spans decades with accumulated expertise and infrastructure supporting diverse cosmetic categories. Export infrastructure facilitates international shipping through proximity to Hong Kong and established logistics networks. Supply chain integration reduces costs and lead times through local sourcing capabilities.

Shanghai represents luxury cosmetic manufacturing hub through premium positioning, international connections, and sophisticated production capabilities serving high-end market segments. Fashion industry influence drives aesthetic innovation and trend awareness supporting premium cosmetic development. International brand presence creates demanding quality standards and manufacturing expertise. Research and development facilities support innovation and product development capabilities.

Our Q&N Guangzhou location provides firsthand experience of regional advantages including access to specialized materials, skilled workforce, and industry expertise concentrated in southern China. The shift toward cream, misty blue, and warm beige color palettes in 2025 cosmetic accessories reflects our ability to adapt quickly to market trends through local supply chain responsiveness.

Shenzhen focuses on innovative cosmetic manufacturing through technology integration, startup ecosystem, and rapid product development capabilities appealing to modern beauty brands. Electronics industry crossover enables smart beauty device production and technology-enhanced cosmetic products. Innovation culture supports rapid prototyping and product development cycles. Young workforce brings fresh perspectives and technological savvy to cosmetic manufacturing.

Yiwu specializes in small commodity manufacturing including basic cosmetic tools and accessories through massive wholesale market ecosystem and low-cost production capabilities. Wholesale market infrastructure facilitates bulk purchasing and international trade relationships. Cost optimization focus provides competitive pricing for basic cosmetic products and tools. Logistics integration supports efficient distribution to global markets.

Dongguan offers contract manufacturing services for international cosmetic brands through established OEM/ODM capabilities and quality control systems. Manufacturing expertise developed through electronics and toy industries transfers to cosmetic production requirements. Quality control systems meet international standards for export-oriented production. Flexibility accommodates various order sizes and customization requirements.

Ningbo provides cosmetic packaging and component manufacturing through specialized industrial base and export-oriented production capabilities. Packaging industry expertise supports diverse cosmetic container and accessory requirements. Port facilities facilitate efficient international shipping and logistics operations. Cost competitiveness combined with quality control appeals to budget-conscious cosmetic brands.

Foshan focuses on specialized cosmetic equipment and machinery manufacturing supporting the broader Chinese cosmetic industry through technology and equipment supply. Manufacturing equipment expertise enables industry growth and capability development. Industrial base provides comprehensive support for cosmetic production facility development. Technical expertise supports equipment maintenance and upgrade services.

Regional specialization analysis reveals distinct advantages and optimal applications for different cosmetic manufacturing requirements and business strategies. Cost optimization regions suit budget-focused products and high-volume requirements. Innovation hubs support premium positioning and technology integration projects. Established clusters provide comprehensive supply chain advantages and industry expertise.

Quality and certification levels vary across regions affecting suitability for different market requirements and regulatory compliance needs. International certification prevalence indicates export readiness and quality system maturity. Regulatory compliance capability determines market access possibilities for finished products. Quality control system sophistication supports consistent product standards and customer satisfaction.

| City | Specialization | Key Advantages | Product Focus | Industry Maturity |

|---|---|---|---|---|

| Guangzhou | Comprehensive ecosystem | Supply chain integration, export | All categories | Very High |

| Shanghai | Luxury positioning | Premium quality, R&D | High-end cosmetics | High |

| Shenzhen | Innovation/technology | Smart products, rapid development | Tech-enhanced beauty | Medium-High |

| Yiwu | Small commodities | Low costs, wholesale markets | Basic tools, accessories | Medium |

| Dongguan | Contract manufacturing | OEM/ODM expertise | Private label | High |

| Ningbo | Packaging/components | Specialized expertise, logistics | Containers, accessories | Medium-High |

How do I find a product manufacturer in China?

Finding reliable Chinese manufacturers requires systematic research, verification, and relationship building across multiple channels and evaluation criteria. Insufficient due diligence leads to quality problems, supply chain disruptions, and business relationship failures affecting long-term success.

Effective Chinese manufacturer discovery combines online platforms, trade shows, industry networks, and verification services enabling comprehensive supplier evaluation and risk management. Our Q&N manufacturing experience reveals successful strategies while 2025 color trends toward cream, misty blue, and warm beige demonstrate importance of aesthetic awareness in supplier selection.

Online platform utilization provides comprehensive manufacturer discovery through specialized B2B websites offering supplier listings, verification systems, and communication tools connecting international buyers with qualified producers. Alibaba dominates Chinese manufacturer discovery through extensive supplier database, verification programs, and integrated communication systems. Global Sources focuses on verified suppliers with export experience and quality certifications. Made-in-China offers alternative supplier base with different verification approaches and industry specializations.

Search optimization strategies maximize platform effectiveness through keyword selection, filter utilization, and supplier evaluation techniques ensuring relevant results and qualified candidates. Product category specification narrows results to relevant manufacturers with appropriate capabilities and experience. Geographic filters identify regional specializations and logistics advantages for specific manufacturing requirements. Certification filters ensure compliance with international standards and quality requirements.

Supplier verification processes evaluate manufacturer credibility, capabilities, and reliability through systematic assessment of credentials, certifications, and performance indicators. Business license verification confirms legal operation status and regulatory compliance. Certification assessment evaluates quality systems, safety standards, and industry-specific qualifications. Customer reference checks provide performance feedback and satisfaction data from existing clients.

Our Q&N experience demonstrates successful manufacturer discovery through combination of online research, trade show participation, and industry networking building lasting business relationships. The growing popularity of cream, misty blue, and warm beige color schemes in 2025 requires manufacturers who understand aesthetic trends and consumer psychology affecting product success.

Trade show participation enables direct manufacturer interaction, product evaluation, and relationship building impossible through online channels alone providing comprehensive assessment opportunities. Canton Fair offers broad manufacturer exposure across diverse industries and product categories. Industry-specific exhibitions provide concentrated supplier access and specialized product focus. Regional trade shows enable local manufacturer discovery and relationship development.

Industry networking leverages professional relationships, association memberships, and referral systems connecting businesses with trusted manufacturer recommendations reducing risk and qualification time. Chamber of commerce connections provide member directories and networking opportunities. Industry association memberships offer supplier referral services and quality assurance programs. Professional service provider recommendations include verified suppliers with proven track records.

Due diligence processes ensure manufacturer qualification through systematic evaluation of production capabilities, quality systems, and business practices protecting investment and ensuring successful partnerships. Factory audit services provide independent verification of manufacturing capabilities and quality control systems. Financial stability assessment evaluates manufacturer viability and long-term partnership potential. Legal compliance verification ensures intellectual property protection and contract enforceability.

Communication assessment evaluates manufacturer responsiveness, language capabilities, and technical understanding ensuring effective collaboration and project management throughout business relationships. Response time measurement indicates customer service priority and operational efficiency levels. English proficiency evaluation ensures clear communication and understanding of requirements. Technical competency assessment verifies manufacturer understanding of product specifications and quality standards.

Sample evaluation processes test manufacturer capabilities through prototype development and quality assessment before committing to larger production orders. Sample quality assessment evaluates manufacturing precision and attention to detail. Specification compliance verification ensures manufacturer understanding and capability to meet requirements. Timeline adherence evaluation indicates operational efficiency and project management capabilities.

Contract negotiation establishes clear expectations, protection mechanisms, and performance standards ensuring successful business relationships and minimizing dispute risks. Minimum order quantity agreements balance production efficiency with inventory investment requirements. Quality specification documentation ensures consistent product standards and performance expectations. Intellectual property protection clauses safeguard proprietary designs and information.

Payment terms negotiation balances cash flow requirements with risk management through structured payment schedules and protection mechanisms. Letter of credit arrangements provide payment security for both parties. Milestone payment schedules align payments with production progress and quality milestones. Quality control checkpoints ensure product standards before payment release.

| Discovery Stage | Key Activities | Success Factors | Common Pitfalls | Risk Mitigation |

|---|---|---|---|---|

| Initial Research | Platform search, basic screening | Comprehensive search, clear criteria | Rushing decisions, limited options | Multiple sources, broad evaluation |

| Qualification | Verification, due diligence | Thorough assessment, documentation | Inadequate verification | Third-party validation |

| Evaluation | Samples, factory visits | Direct assessment, relationship building | Remote evaluation only | Personal interaction |

| Negotiation | Terms, contracts, agreements | Clear expectations, mutual benefit | One-sided agreements | Legal guidance |

| Partnership | Ongoing management, performance | Communication, monitoring | Neglecting relationship | Regular review |

Conclusion

Successful cosmetic manufacturer discovery requires systematic platform research, trade show networking, and thorough verification processes, with Guangzhou leading Chinese production capabilities while 2025 trends favor cream, misty blue, and warm beige aesthetic positioning.

Q&N Fashion Factory

Q&N Fashion Factory