Is cosmetic a profitable business?

Cosmetic businesses demonstrate strong profitability potential through high margins, growing demand, and diverse market opportunities. Poor planning, quality issues, and inadequate market research lead to financial losses and business failures in competitive beauty markets.

Cosmetic businesses achieve 15-30% profit margins through premium positioning, efficient operations, and strong brand development. Q&N supports profitable cosmetic ventures with lazy makeup bags trending in 2025 featuring all-in-one storage solutions for enhanced consumer convenience and market differentiation.

After serving the beauty industry for over 15 years through our Q&N cosmetic bag manufacturing, I've witnessed countless entrepreneurs build profitable cosmetic businesses while others struggle with market challenges. The 2025 trend toward lazy makeup bags with all-in-one storage reflects consumers' increasing demand for convenience, creating new profit opportunities for businesses addressing modern lifestyle needs.

How do I create my own cosmetic?

Creating cosmetic products requires understanding formulation science, regulatory compliance, and manufacturing processes while maintaining safety and quality standards. Poor development approaches lead to unsafe products, regulatory violations, and market failures.

Create cosmetics by researching formulations, partnering with certified manufacturers, conducting safety testing, and ensuring regulatory compliance. Q&N supports cosmetic creators with lazy makeup bags trending in 2025 providing all-in-one storage solutions for comprehensive product presentation and consumer convenience.

Product concept development establishes the foundation for cosmetic creation by identifying target consumers, addressing specific needs, and defining unique value propositions. Market research reveals unmet consumer needs and competitive opportunities. Consumer surveys validate product concepts and preference priorities. Trend analysis identifies emerging opportunities and market timing considerations.

Formulation development translates product concepts into viable cosmetic compositions through scientific expertise and ingredient knowledge. Ingredient research identifies suitable raw materials meeting performance and safety requirements. Compatibility testing ensures ingredient interactions don't compromise product integrity. Stability testing validates formulation performance throughout expected shelf life under various storage conditions.

Our Q&N experience working with cosmetic creators reveals the importance of comprehensive planning from product development through market presentation. The 2025 lazy makeup bag trend demonstrates how convenience factors influence product success significantly. All-in-one storage solutions reflect consumer preferences for simplified beauty routines and organized product presentation.

Regulatory compliance represents critical requirements for cosmetic creation ensuring consumer safety and legal market access. FDA registration provides documentation for US market entry requiring ingredient disclosure and safety data. International regulations demand additional testing and certification procedures for global distribution. Labeling requirements ensure proper consumer information and usage instructions.

Manufacturing partnerships enable cosmetic creators to access production capabilities without massive capital investment in equipment and facilities. Contract manufacturers provide formulation expertise and quality control systems. Private label options reduce development costs and accelerate time-to-market requirements. Minimum order quantities affect initial investment and inventory management strategies.

Quality control systems ensure consistent product performance and consumer safety throughout production cycles preventing costly recalls and reputation damage. Incoming ingredient inspection prevents contaminated materials from entering production processes. In-process monitoring verifies formulation accuracy and manufacturing standards. Final testing validates finished products before consumer distribution and market release.

Packaging development protects product integrity while supporting brand identity and consumer convenience throughout the usage lifecycle. Container selection considers product compatibility, user experience, and cost optimization. Label design communicates brand values and regulatory compliance information effectively. Our Q&N lazy makeup bags provide additional protection and organization enhancing overall product presentation.

Testing procedures validate cosmetic safety and performance before market introduction ensuring consumer satisfaction and regulatory compliance. Stability testing confirms product integrity under various environmental conditions and storage scenarios. Efficacy testing documents performance claims supporting marketing messages and consumer expectations. Safety testing prevents adverse reactions and ensures consumer protection.

Brand development creates market differentiation and consumer recognition essential for competitive success in crowded cosmetic markets. Brand identity establishes visual consistency across product lines and marketing materials. Positioning strategy communicates unique value propositions and target consumer benefits. Marketing materials support brand awareness and customer acquisition efforts.

Scale planning addresses growth requirements and operational expansion needs as cosmetic businesses develop and market demand increases. Production capacity must accommodate increasing demand without compromising quality standards or customer satisfaction. Supply chain management ensures reliable ingredient availability and cost control. International expansion requires additional regulatory compliance and distribution capabilities.

| Creation Phase | Key Requirements | Professional Support | Success Factors |

|---|---|---|---|

| Concept Development | Market research, consumer insights | Industry expertise | Clear value proposition |

| Formulation | Scientific knowledge, testing | Contract manufacturers | Safety and effectiveness |

| Compliance | Regulatory understanding, documentation | Legal consultation | Proper registration |

| Manufacturing | Production capabilities, quality control | Manufacturing partners | Consistent quality |

| Presentation | Packaging design, brand identity | Q&N storage solutions | Professional appearance |

Is it profitable to make cosmetics?

Cosmetic manufacturing profitability depends on market positioning, operational efficiency, and brand development strategies while managing production costs and competitive pressures. Poor cost management and market positioning lead to unprofitable operations despite industry growth potential.

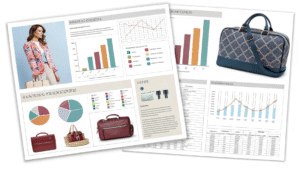

Cosmetic manufacturing achieves profitability through premium positioning, efficient operations, and strong brand development with margins ranging from 15-40% depending on market segment. Q&N observes profitable cosmetic makers emphasizing convenience features like lazy makeup bags trending in 2025 for enhanced consumer value.

cosmetic manufacturing profitability factors

Manufacturing cost structure significantly impacts cosmetic profitability through raw material expenses, production efficiency, and quality control investments affecting overall margin potential. Premium ingredients command higher prices but enable luxury positioning and increased margins. Bulk purchasing reduces material costs but requires capital investment and storage capabilities. Production automation improves efficiency while maintaining quality consistency.

Market positioning determines pricing power and profit potential across different cosmetic categories and consumer segments. Luxury cosmetics achieve higher margins through premium positioning but require significant marketing investment and brand development. Mass market products compete on value pricing but benefit from volume sales and operational efficiency. Niche products serve specialized needs enabling premium pricing despite smaller market size.

Our Q&N observations serving diverse cosmetic manufacturers reveal profitability patterns across different business models and market approaches. Companies emphasizing convenience and organization through accessories like lazy makeup bags often achieve higher customer satisfaction and repeat purchases. The 2025 all-in-one storage trend creates additional revenue opportunities through comprehensive product offerings.

Brand strength influences profitability through customer loyalty, pricing power, and marketing efficiency enabling sustainable competitive advantages. Strong brands command premium pricing and resist competitive pressure from lower-priced alternatives. Brand recognition reduces customer acquisition costs and supports expansion into new product categories. Consumer trust enables higher margins and reduces price sensitivity.

Distribution strategy affects profitability through margin structures, market reach, and operational costs across different sales channels. Direct-to-consumer sales provide higher margins but require marketing investment and fulfillment capabilities. Retail partnerships offer broader reach but demand wholesale pricing and promotional support. E-commerce platforms balance reach with margin considerations and operational requirements.

Production scale impacts profitability through fixed cost absorption, bulk purchasing advantages, and operational efficiency improvements. Higher production volumes reduce per-unit fixed costs improving overall margin structure. Equipment utilization optimization maximizes return on capital investment. Quality systems become more efficient at scale reducing inspection and testing costs per unit.

Innovation investment drives long-term profitability through product differentiation and competitive positioning enabling premium pricing and market leadership. Research and development creates patented formulations commanding higher margins. Packaging innovation provides functional benefits justifying price premiums. Our Q&N innovation in lazy makeup bags demonstrates how convenience features enhance product value significantly.

Operational efficiency improvements enhance profitability through cost reduction and quality consistency while maintaining competitive positioning. Lean manufacturing principles eliminate waste and optimize resource utilization. Automated systems reduce labor costs and improve precision. Preventive maintenance minimizes equipment downtime and quality variations.

Market timing affects profitability through demand cycles, competitive dynamics, and regulatory changes creating opportunities and challenges. Trend identification enables early market entry and premium positioning. Seasonal demand patterns require inventory and production planning optimization. Economic conditions influence consumer spending and price sensitivity across different market segments.

International expansion provides profitability growth opportunities while requiring additional investment in regulatory compliance and market development. Export markets offer revenue diversification and growth potential. Regional preferences create opportunities for specialized product development. Currency fluctuations affect international profitability and require hedging strategies.

| Profitability Driver | Impact Level | Optimization Strategy | Q&N Support |

|---|---|---|---|

| Premium Positioning | High | Unique value proposition | Elegant presentation accessories |

| Production Efficiency | Medium | Automated manufacturing | Quality storage solutions |

| Brand Development | High | Consistent identity | Coordinated packaging systems |

| Market Timing | Medium | Trend awareness | Convenience-focused innovations |

| Distribution Optimization | Medium | Multi-channel strategy | Professional presentation tools |

Which beauty business is most profitable?

Beauty business profitability varies across skincare, makeup, fragrance, and accessory segments with different margin structures and market dynamics. Understanding segment characteristics helps entrepreneurs select optimal market entry strategies and business models.

Skincare businesses achieve highest profitability through premium positioning and repeat purchase patterns, while cosmetic accessories provide stable margins through functionality focus. Q&N specializes in profitable accessory markets with lazy makeup bags trending in 2025 offering all-in-one convenience solutions.

Skincare represents the most profitable beauty segment through premium positioning, perceived efficacy, and consumer willingness to invest in long-term benefits. Anti-aging products command highest margins through scientific positioning and emotional benefits. Specialized treatments for specific skin concerns enable premium pricing and customer loyalty. Natural and organic skincare captures growing consumer preferences for clean beauty solutions.

Professional beauty services achieve high profitability through skilled labor pricing and personalized service delivery creating emotional connections and customer loyalty. High-end salons and spas command premium pricing through luxury positioning and comprehensive service offerings. Specialized treatments like medical aesthetics provide exceptional margins through expertise and equipment requirements. Training and certification programs create additional revenue streams while building professional networks.

Our Q&N specialization in cosmetic accessories reveals consistent profitability through functional value and replacement cycles creating predictable revenue streams. The 2025 lazy makeup bag trend demonstrates how convenience innovations drive consumer purchasing decisions. All-in-one storage solutions address modern lifestyle needs while providing manufacturers with differentiation opportunities and margin protection.

Luxury fragrance maintains strong profitability through emotional positioning, brand prestige, and high margin structures despite lower purchase frequency. Designer collaborations create exclusive positioning and premium pricing opportunities. Limited editions generate excitement and urgency driving sales volumes. Brand licensing provides additional revenue without manufacturing investment.

Color cosmetics profitability varies significantly between mass market and prestige segments with different competitive dynamics and margin structures. Trend-driven products create frequent replacement cycles and impulse purchasing. Seasonal collections provide marketing opportunities and inventory turnover. Professional makeup lines serve specialized markets with higher margins and customer loyalty.

Beauty subscription services achieve profitability through recurring revenue models and customer lifetime value optimization while reducing customer acquisition costs. Personalization algorithms improve customer satisfaction and retention rates. Bulk purchasing enables cost advantages and exclusive product offerings. Data collection provides valuable insights for product development and marketing optimization.

Private label cosmetics provide profitable opportunities through reduced marketing costs and established distribution relationships while leveraging existing brand equity. Retailer partnerships offer guaranteed shelf space and promotional support. Contract manufacturing enables focus on marketing and brand development. Quality control ensures consistent performance and brand protection.

E-commerce beauty platforms achieve profitability through global reach, reduced overhead costs, and direct customer relationships enabling higher margins than traditional retail. Digital marketing provides targeted customer acquisition and retention strategies. Inventory optimization reduces carrying costs and obsolescence risks. Customer data enables personalized recommendations and increased sales conversion.

Organic and natural beauty businesses command premium pricing through clean ingredient positioning and environmental consciousness appealing to growing consumer segments. Certification requirements create barriers to entry and competitive protection. Sustainable packaging appeals to environmentally conscious consumers. Ingredient transparency builds trust and customer loyalty.

Beauty education and training services provide profitable opportunities through recurring revenue, high margins, and scalable delivery models serving professional and consumer markets. Online courses reduce delivery costs while expanding market reach. Certification programs create ongoing relationships and revenue streams. Equipment and supply sales provide additional revenue opportunities.

| Beauty Segment | Profit Margin Range | Key Success Factors | Q&N Market Position |

|---|---|---|---|

| Skincare | 25-50% | Scientific positioning, repeat purchases | Protective storage solutions |

| Professional Services | 30-60% | Skilled expertise, premium positioning | Professional organization tools |

| Luxury Fragrance | 40-70% | Brand prestige, emotional connection | Elegant presentation accessories |

| Cosmetic Accessories | 20-40% | Functional value, convenience features | Lazy makeup bag innovations |

| Subscription Services | 15-35% | Recurring revenue, customer retention | Organized storage systems |

Conclusion

Cosmetic businesses demonstrate strong profitability potential through strategic positioning and operational efficiency, with Q&N supporting success through lazy makeup bags trending in 2025 providing all-in-one convenience solutions.

Q&N Fashion Factory

Q&N Fashion Factory