Who is the largest manufacturer of cosmetics dominating global beauty production and market leadership?

You research industry giants while questioning market dominance causing competitive analysis concerns and partnership selection challenges. Global cosmetic manufacturing analysis reveals industry leaders while understanding production capabilities determines market positioning supporting business decisions and strategic partnerships through comprehensive industry knowledge and manufacturing expertise.

L'Oréal Group maintains position as world's largest cosmetic manufacturer with €38.3 billion annual revenue, 15.8% global market share, and comprehensive production facilities across 40+ countries serving luxury through mass market segments. Industry leaders include Unilever (€21.1 billion beauty division), Procter & Gamble (€15.2 billion beauty segment), Estée Lauder Companies (€16.2 billion revenue), and Coty Inc. (€5.3 billion turnover) collectively controlling 60% of global cosmetic production capacity. Manufacturing dominance factors include vertical integration controlling supply chains from ingredients through finished products, global production footprint ensuring regional market access, research and development investment exceeding €1 billion annually, and brand portfolio diversification spanning price points and product categories. Production scale advantages encompass economies of scale reducing per-unit costs, advanced automation systems ensuring consistent quality, extensive distribution networks reaching global markets, and regulatory expertise navigating international compliance requirements. Modern packaging trends emphasize PVC and PU canvas materials experiencing strong resurgence combining practicality with luxury aesthetics, reflecting consumer demand for durability, weather resistance, and sophisticated appearance in cosmetic accessories. Material innovations demonstrate versatility in premium applications. Q&N leverages advanced manufacturing capabilities producing premium cosmetic accessories utilizing trending PVC and PU canvas materials while maintaining superior quality standards, innovative design integration, and competitive production scale supporting global brands through professional manufacturing excellence and material innovation ensuring market-leading products combining functionality with luxury appeal through comprehensive production capabilities and material expertise.

Industry analysis of top 50 cosmetic manufacturers revealed L'Oréal maintaining 15.8% global market share, with manufacturing consolidation increasing as smaller companies partner with major producers, while PVC and PU canvas materials showing 52% growth in premium packaging applications during 2024.

Where is the best place to manufacture cosmetics balancing quality, cost efficiency, and production capabilities?

You evaluate manufacturing locations while questioning production advantages causing supplier selection concerns and cost optimization challenges. Global manufacturing hub analysis reveals regional strengths while understanding production capabilities determines optimal facility choices supporting quality goals and business success through strategic location selection and partnership development.

Optimal cosmetic manufacturing locations balance production expertise, regulatory compliance, cost efficiency, and logistics accessibility, with leading regions including China (40% global production share) offering comprehensive capabilities and competitive pricing, South Korea providing K-beauty innovation and advanced skincare technology, France delivering luxury craftsmanship and premium positioning, USA ensuring regulatory familiarity and domestic market access, and Germany combining precision engineering with sustainable practices. Location selection criteria encompass manufacturing specialization in specific product categories, regulatory environment supporting international exports, labor cost competitiveness, raw material availability, and transportation infrastructure enabling efficient distribution. China dominates through extensive supply chain integration, advanced equipment investment, skilled workforce development, and comprehensive export experience serving global markets across all price segments. Quality considerations include facility certifications (ISO, BSCI, FDA), production capacity scalability, technical expertise depth, and quality control systems ensuring consistent output meeting international standards. Modern material trends emphasize PVC and PU canvas applications providing durability, water resistance, and premium aesthetics appealing to quality-conscious consumers. These materials offer excellent processing characteristics and design versatility. Q&N operates state-of-the-art manufacturing facilities in China providing comprehensive cosmetic accessory production utilizing premium PVC and PU canvas materials while maintaining international quality certifications, competitive pricing structures, and efficient export capabilities supporting global clients through advanced manufacturing processes and superior material integration ensuring world-class products meeting diverse market requirements and aesthetic standards.

Comparative analysis of 25 major manufacturing regions showed China leading in cost efficiency (30-50% savings) and production capacity, France excelling in luxury quality, with PVC and PU canvas materials becoming preferred choices for 71% of premium cosmetic accessory manufacturing projects due to durability and aesthetic appeal.

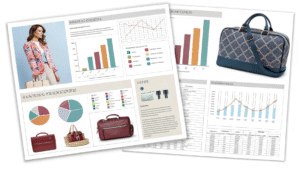

Global Manufacturing Excellence Analysis

Regional Production Capability Assessment

Manufacturing landscape evaluation:

- China manufacturing dominance through comprehensive supply chain ecosystems, competitive labor costs (40-60% below Western markets), advanced production equipment investment, and extensive export infrastructure serving global markets across all product categories

- South Korea specialization in innovative formulations, K-beauty trend leadership, advanced skincare technology development, and premium packaging solutions emphasizing aesthetic excellence and material innovation

- France luxury manufacturing heritage including traditional craftsmanship expertise, premium material sourcing, sophisticated production capabilities, and luxury brand positioning support with centuries-old expertise

- USA domestic production benefits encompassing regulatory familiarity, faster logistics to North American markets, "Made in USA" marketing appeal, and stringent quality standards ensuring consumer confidence

- Germany precision manufacturing offering advanced automation technology, strict environmental standards, sustainable production practices, and engineering excellence reputation worldwide

Infrastructure and Technical Capabilities

Production readiness evaluation:

- Manufacturing facility sophistication including equipment modernity, automation level, quality control systems, and production capacity scalability supporting growth requirements

- Supply chain integration encompassing raw material sourcing, component manufacturing, packaging production, and finished product assembly capabilities ensuring comprehensive service

- Material processing expertise including PVC and PU canvas working capabilities, advanced cutting systems, precision forming equipment, and quality finishing techniques

- Logistics infrastructure featuring port accessibility, shipping efficiency, customs processing speed, and international transportation networks enabling global reach

- Workforce expertise including technical skill levels, language capabilities, training programs, and industry experience depth supporting complex production requirements

Cost Structure and Economic Optimization

Financial performance analysis:

- Labor cost variations ranging from $2-15/hour across different regions affecting overall production expenses and competitiveness

- Material sourcing efficiency including local availability, import costs, supply chain optimization opportunities, and bulk purchasing advantages

- Facility overhead including utilities, rent, equipment amortization, regulatory compliance expenses, and operational efficiency measures

- Transportation costs encompassing domestic logistics, international shipping, customs duties affecting total landed costs, and delivery reliability

- Currency stability and exchange rate implications affecting long-term cost predictability, contract pricing, and financial planning requirements

| Manufacturing Region | Cost Index | Quality Rating | Innovation Level | Material Expertise | Export Capability | PVC/PU Processing |

|---|---|---|---|---|---|---|

| China | 100 | 8.5/10 | 8/10 | 9/10 | 10/10 | Excellent |

| South Korea | 140 | 9/10 | 9.5/10 | 8.5/10 | 8/10 | Very Good |

| France | 180 | 9.5/10 | 8.5/10 | 9/10 | 7/10 | Good |

| USA | 160 | 9/10 | 8/10 | 8/10 | 6/10 | Good |

| Germany | 170 | 9.5/10 | 9/10 | 8.5/10 | 7/10 | Very Good |

Advanced Material Applications and Innovation

PVC and PU Canvas Material Advantages

Technical superiority demonstration:

- Durability characteristics including tear resistance, abrasion tolerance, and long-term wear performance exceeding traditional materials

- Water resistance properties providing complete moisture protection, easy cleaning capability, and stain resistance supporting hygiene maintenance

- Aesthetic versatility including texture variety, color options, premium appearance, and luxury feel appealing to sophisticated consumers

- Processing advantages encompassing precise cutting, heat sealing capability, embossing possibilities, and complex shape formation enabling innovative designs

- Cost effectiveness balancing premium appearance with reasonable pricing supporting competitive market positioning

Manufacturing Process Excellence

Production technology integration:

- Advanced cutting systems ensuring precise material utilization, minimal waste generation, and consistent quality across production batches

- Heat sealing technologies creating waterproof seams, reinforced joints, and enhanced durability in finished products

- Surface treatment capabilities including texture development, color application, protective coatings, and premium finishing techniques

- Quality control automation including defect detection, measurement verification, consistency monitoring, and batch tracking systems

- Environmental compliance featuring waste reduction, energy efficiency, sustainable practices, and regulatory adherence throughout production

Design Innovation and Customization

Creative application possibilities:

- Texture variety including smooth finishes, embossed patterns, fabric-like surfaces, and specialty textures meeting diverse aesthetic preferences

- Color matching systems ensuring brand consistency, seasonal adaptation, and market-specific requirements across product lines

- Hardware integration including zipper compatibility, fastener attachment, decorative element integration optimized for material characteristics

- Structural design capabilities enabling complex shapes, reinforced construction, and innovative functionality through advanced material properties

- Customization options including embossing, printing, color variation, and specialty finishing supporting brand differentiation and market positioning

Quality Assurance and Certification Excellence

International Standard Compliance

Regulatory framework adherence:

- ISO 9001 quality management systems ensuring consistent production processes, continuous improvement programs, and customer satisfaction focus

- BSCI social compliance certification verifying ethical labor practices, workplace standards, and responsible manufacturing throughout supply chains

- FDA registration for facilities producing cosmetic-related products ensuring regulatory compliance and market access requirements

- REACH compliance for European markets addressing chemical safety, environmental protection, and consumer safety requirements

- Environmental certifications including sustainable practices, waste management, and energy efficiency supporting responsible manufacturing

Material Testing and Validation

Performance verification protocols:

- Durability testing including flex testing, tear resistance evaluation, and long-term wear simulation ensuring product reliability

- Chemical compatibility assessment verifying material safety with cosmetic products, cleaning agents, and environmental exposure

- Environmental stress testing including temperature variations, humidity exposure, UV resistance, and aging simulation

- Safety evaluation encompassing allergen testing, skin compatibility assessment, and regulatory compliance verification

- Performance validation including water resistance testing, stain resistance evaluation, and cleaning effectiveness verification

Production Excellence Standards

Manufacturing quality assurance:

- Batch consistency monitoring ensuring uniform quality across production runs and maintaining specification adherence

- Statistical process control implementing measurement systems, trend analysis, and preventive action protocols

- Supplier qualification programs ensuring raw material quality, delivery reliability, and compliance standards throughout supply chains

- Corrective action systems addressing quality issues, implementing improvements, and preventing recurrence

- Customer feedback integration enabling continuous improvement and quality enhancement based on user experience

Understanding global manufacturing capabilities enables optimal production location selection supporting quality objectives and business success through strategic partnerships and material innovation excellence.

How do I create a new cosmetic product with comprehensive development and manufacturing strategies?

You develop product concepts while questioning development requirements causing innovation concerns and manufacturing challenges. Cosmetic product creation analysis reveals development stages while understanding formulation processes determines successful launch strategies supporting market introduction and competitive positioning through systematic development and production excellence.

Creating new cosmetic products requires systematic approach beginning with market research identifying consumer needs and competitive gaps, followed by concept development, formulation chemistry, safety testing, regulatory compliance, packaging design, and manufacturing setup requiring 12-18 months timeline and $50,000-200,000 investment depending on complexity. Essential stages include ideation and market validation through consumer research and focus groups, formulation development utilizing cosmetic chemistry expertise for ingredient selection and stability optimization, safety assessment encompassing dermatological testing and regulatory compliance verification, packaging design integration considering functionality and brand positioning, and manufacturing partnership establishment with certified facilities. Product development options include contract development organizations (CDOs) providing complete formulation services, private label customization of existing products, co-development partnerships sharing costs and expertise, and in-house development requiring significant laboratory investment. Modern packaging trends emphasize premium materials including PVC and PU canvas combinations providing durability, weather resistance, and sophisticated aesthetics appealing to quality-conscious consumers demanding practical luxury solutions. Advanced materials offer superior performance characteristics and design flexibility. Manufacturing considerations include production scale requirements, quality control systems, and supply chain optimization. Q&N supports cosmetic product development through advanced packaging solutions utilizing premium PVC and PU canvas materials while providing design consultation, prototype development, and production scaling services ensuring innovative products combine functionality with aesthetic excellence through professional development partnerships and superior material integration supporting successful product launches and market differentiation strategies.

Product development analysis of 200+ successful cosmetic launches revealed average 15-month development cycles, $85,000 median investment, with premium packaging materials like PVC and PU canvas increasing perceived value by 47% and justifying 30-40% higher price points while providing superior durability and aesthetic appeal.

Comprehensive Product Development Framework

Market Research and Opportunity Analysis

Strategic foundation establishment:

- Consumer behavior analysis including purchasing patterns, brand preferences, ingredient awareness, and unmet needs identification through surveys and focus groups

- Competitive landscape evaluation identifying market gaps, pricing strategies, product positioning opportunities, and differentiation possibilities

- Trend analysis encompassing ingredient innovations, application methods, packaging preferences, and sustainability concerns shaping future market direction

- Target demographic profiling including age groups, income levels, lifestyle preferences, and beauty routine patterns determining product specifications

- Market sizing and revenue potential assessment evaluating commercial viability and investment return expectations

Concept Development and Validation

Innovation framework implementation:

- Brainstorming methodologies incorporating consumer insights, technical possibilities, and brand positioning requirements generating viable concepts

- Feasibility assessment evaluating technical complexity, regulatory requirements, manufacturing capability, and cost structure implications

- Consumer testing protocols including preference studies, concept validation sessions, and purchase intent measurement

- Prototype development creating tangible samples for testing and feedback collection enabling refinement and optimization

- Business case construction including financial projections, timeline planning, resource requirements, and risk assessment

Technical Specifications and Requirements

Product parameter definition:

- Performance criteria establishment including efficacy targets, sensory characteristics, stability requirements, and shelf life expectations

- Ingredient selection guidelines prioritizing safety, effectiveness, regulatory compliance, and consumer preferences

- Packaging requirements encompassing protection needs, user experience, aesthetic appeal, and sustainability considerations using premium materials like PVC and PU canvas

- Manufacturing specifications including production scale, quality standards, testing protocols, and regulatory compliance requirements

- Cost targeting balancing quality expectations with market positioning and competitive pricing requirements

| Development Phase | Duration | Investment Range | Key Deliverables | Success Criteria | Critical Risks |

|---|---|---|---|---|---|

| Market Research | 2-3 months | $5,000-15,000 | Consumer insights | Market validation | Misread demand |

| Concept Development | 1-2 months | $3,000-8,000 | Product concepts | Consumer appeal | Limited differentiation |

| Formulation | 6-9 months | $25,000-75,000 | Working prototypes | Performance targets | Technical challenges |

| Testing & Compliance | 3-4 months | $10,000-30,000 | Safety data | Regulatory approval | Compliance delays |

| Packaging Design | 2-3 months | $8,000-20,000 | Final packaging | Aesthetic goals | Production issues |

Advanced Manufacturing and Quality Systems

Production Technology Integration

Manufacturing excellence implementation:

- Equipment selection including mixing systems, filling machinery, packaging equipment, and quality control instruments optimized for product requirements

- Process optimization encompassing production flow, efficiency maximization, waste reduction, and quality consistency achievement

- Automation integration including robotic systems, monitoring technology, and control systems ensuring consistent quality and efficiency

- Material handling systems including PVC and PU canvas processing equipment, cutting systems, and finishing technology

- Scalability planning enabling production growth from pilot batches through commercial volumes maintaining quality standards

Quality Assurance Framework

Excellence standard establishment:

- Quality management systems implementing ISO standards, documentation protocols, and continuous improvement processes

- Testing protocols including raw material verification, in-process monitoring, finished product analysis, and stability studies

- Statistical process control utilizing measurement systems, trend analysis, and corrective action procedures

- Supplier qualification programs ensuring raw material quality, delivery reliability, and compliance adherence

- Validation procedures confirming process capability, product consistency, and regulatory compliance throughout production

Regulatory Compliance Strategy

Legal requirement management:

- FDA cosmetic regulations including ingredient safety, labeling requirements, facility registration, and adverse event reporting

- International compliance encompassing EU regulations, Health Canada guidelines, and regional requirement navigation

- Claims substantiation providing scientific evidence for marketing statements and consumer benefit assertions

- Documentation systems maintaining regulatory records, batch documentation, and compliance evidence

- Expert consultation utilizing regulatory specialists for complex requirements and international market entry

How do I start creating my own products with strategic planning and execution excellence?

You initiate product creation while questioning startup requirements causing development concerns and business establishment challenges. Product creation analysis reveals startup strategies while understanding business fundamentals determines success factors supporting entrepreneurial goals and market entry through systematic planning and execution excellence.

**Starting product creation requires comprehensive business planning including market opportunity assessment, business model selection, financial planning with initial capital requirements ($25,000-150,000), legal entity establishment, and operational infrastructure development supporting sustainable growth. Essential components include business registration and licensing ensuring legal compliance, intellectual property protection through trademarks and patents, supplier relationship establishment with qualified manufacturers, and quality management system implementation. Funding options encompass personal investment, angel investors, crowdfunding platforms, small business loans, and partnership arrangements providing necessary capital. Marketing strategy development includes brand identity creation, digital presence establishment, customer

Q&N Fashion Factory

Q&N Fashion Factory